Gooding Christie’s at Rétromobile 2026: A Paris Debut Worth €50 Million

Gooding Christie’s debuted at Rétromobile 2026

When Rétromobile opens its doors in Paris, the show floor is only half the story. The other half plays out under bright lights and louder emotions, where bidders try to turn taste into timing. In 2026, that theatre got a new lead: Gooding Christie’s stepped in as the official auction partner and staged its inaugural Paris sale at Paris Expo Porte de Versailles. The headline number was hard to ignore, with €50,414,800 in total sales and an 80% sell-through rate—an emphatic first statement in a city that already treats collector cars like a serious cultural asset.

What made the Gooding Christie’s Rétromobile 2026 auction especially interesting was not just the money. It was the mix. The catalogue leaned into the breadth of the hobby, from prewar sculpture to modern, track-only Ferraris, and the results showed where the market is feeling confident—and where it is suddenly picky.

The Top Lot: Ferrari 288 GTO Resets the Bar

The car that defined the sale was also the car that made the clearest argument for “best-in-class” still being the safest bet. A 1984 Ferrari 288 GTO sold for €9,117,500, setting a new auction record for the model according to Gooding Christie’s own post-sale reporting.

The 288 GTO sits in a sweet spot that buyers rarely argue with: homologation-era mythology, limited production, unmistakable silhouette, and a story that bridges road and race without needing to be explained. What matters in 2026 is that bidders treated it less like a “classic supercar” and more like a cornerstone object—something closer to blue-chip art than weekend toy. That tone carried through the rest of the top end of the sale.

Track-Only Ferrari Fever: FXX K Evo and FXX Evo Deliver

If the 288 GTO was the emotional anchor, the modern Ferrari prototypes provided the adrenaline. A 2018 Ferrari FXX K Evo achieved €6,980,000, a standout result that Gooding Christie’s and several market roundups framed as a record-level moment for this ultra-rare, program-only type of car.

Close behind, the 2008 Ferrari FXX Evo sold for €4,448,750, reinforcing a pattern that has become difficult to dismiss: buyers will pay aggressively for experiences they cannot replicate, especially when the factory narrative is part of the ownership.

In practical terms, these cars are not about ease. They are about access. Ownership often implies storage, servicing, logistics, and a calendar of curated track moments. That is exactly the point. In a market that has matured and segmented, the top buyers are increasingly selecting cars that behave like memberships—rare, structured, and socially meaningful.

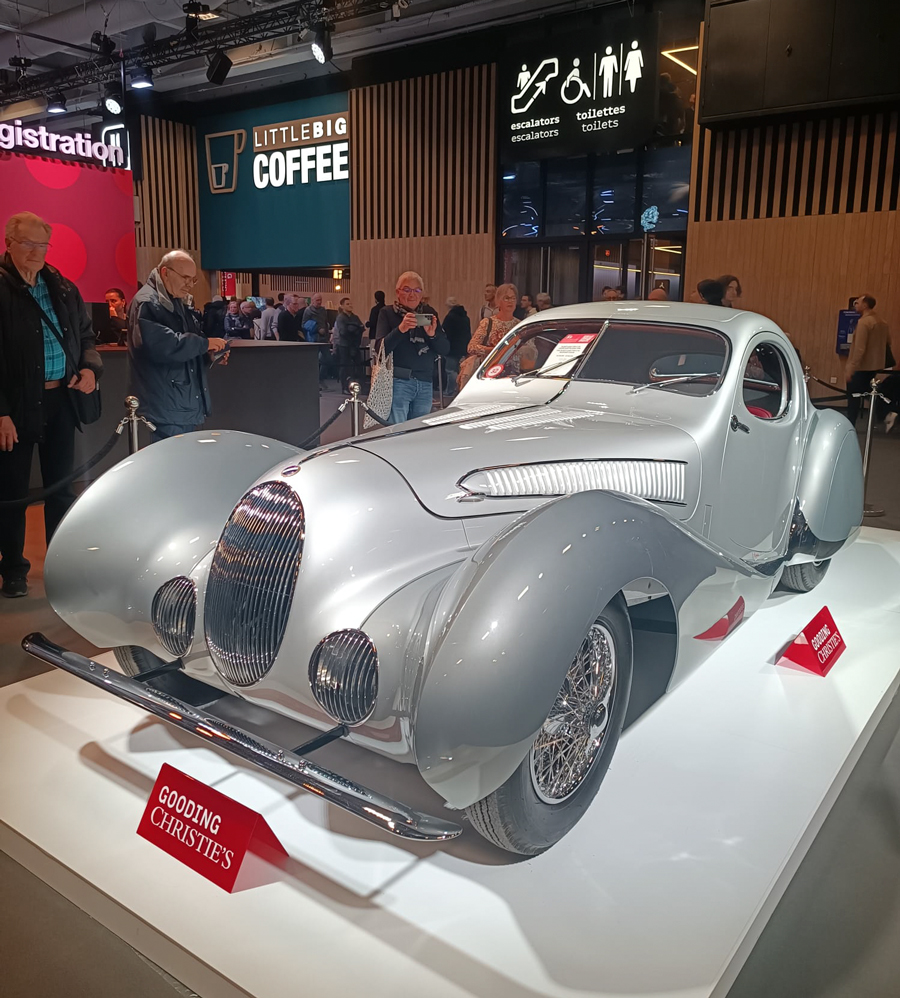

The French Counterweight: Talbot-Lago Teardrop and the Art of Presence

Modern hyper-exotics may grab the loudest headlines, but Paris will always reserve a special reverence for prewar and coachbuilt elegance. The 1938 Talbot-Lago T150-C-SS Teardrop Coupé delivered on that expectation, selling for €6,755,000.

This is the kind of result that reminds everyone why Rétromobile matters. A great Teardrop does not need explaining. It simply occupies the room. It also speaks directly to European collecting culture, where design lineage and coachbuilder identity can be as important as horsepower or lap times.

A Sale of Contrasts: Big Wins, Visible No-Sales

For all the strength at the top, the sale also showed clear selectivity. Several major estimated lots did not sell, including a 1960 Ferrari 250 GT SWB (estimated €8,000,000–€9,000,000) and a 1958 Ferrari 250 GT LWB California Spider (estimated €5,500,000–€6,500,000).

That split is the real story of Rétromobile 2026: buyers were willing to spend, but they wanted the numbers to feel justified by specification, history, and market comparables. The unsold results do not read like a collapse. They read like negotiation—an increasingly common theme when sellers aim high and bidders know they have alternatives.

The middle of the catalogue reflects the same discipline. A 1971 Lamborghini Miura SV brought €3,380,000, a serious number that suggests the very best versions of landmark models remain liquid. Yet nearby, other respected classics stalled if the estimate or configuration felt even slightly misaligned with current demand.

Where the Energy Was: Icon Cars, Usable Classics, and the EU Context

Gooding Christie’s positioned the Paris auction as a bridge between global collecting and European practicality. In a European sale, the buyer’s calculus often includes location, paperwork, and tax structure, not just the hammer price. That matters because it changes the buyer pool. A Paris auction can be more than a glamorous stop on the calendar; it can be a strategic place to transact for collectors who want EU-friendly logistics.

Market commentary around the week also emphasized how varied the Paris auction ecosystem felt in 2026, with different houses seeing different strengths across categories. In that setting, Gooding Christie’s looked most powerful when selling cars that are instantly legible at an international level: headline Ferraris, major design-era coachbuilt icons, and rare-spec modern collectibles.

What the Results Say About 2026

The simplest reading is that the top of the market remains confident. But the more useful reading is that collectors are narrowing their definition of “must-have.”

Cars that sit at the intersection of rarity, story, and recognizability are doing the heavy lifting. That includes a 288 GTO that feels like a permanent artifact, and track-only Ferraris that offer controlled scarcity. On the other side, even revered classics can hesitate if the price feels like it is forecasting a future that bidders are not ready to underwrite.

In that sense, Gooding Christie’s Paris debut was a strong start, but also a clear snapshot of a market that is maturing fast. The excitement is still there. The room still wants to be surprised. It just wants the math to make sense.

Final Take

Rétromobile has always been a show about memory, but the auction is about conviction. In 2026, Gooding Christie’s brought a catalogue built for global attention and proved it could convert attention into sales—more than €50 million worth.

The biggest winners were not just “the best cars.” They were the clearest cars: the ones whose value story is simple, defensible, and emotionally immediate. And in a Paris week filled with choices, that clarity was the most expensive commodity of all.